- FII’s bought 4.9 K contract of Index Future worth 332 cores ,8.4 K Long contract were added by FII’s and 2.1 K short contracts were added by FII’s. Net Open Interest decreased by 7.7 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. When not to Trade

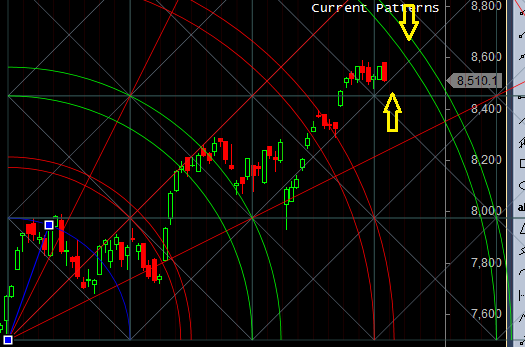

- As discussed in Yesterday Analysis Bulls should protect 8490 else we can see a quick correction till 8410-8400. Bullish on close above 8577 for target of 8650, Expect impulsive move in next 2 trading sessions. High made was 8585 so bulls unable to break 8577 gann numbers on closing basis but bears also unable to close below 8490, Low was 8503 , suggesting fight between bulls and bears for close below 8490 or above 8577. Close above 8577 or below 8490 can see a move of 100 points. Beauty of this bull run from 6825 is time correction, current move also its 8 days we have been trading in range of 8594-8476 suggesting time correction and another trending move of 200-250 points on cards. Bank Nifty reacts from gann arc,EOD Analysis

- Nifty July Future Open Interest Volume is at 2.31 core with liquidation of 3.9 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover is at 73% and Rollover cost @8204 closed above it

- Total Future & Option trading volume was at 4.7 Lakh core with total contract traded at 1.2 lakh , PCR @0.89, Trader’s Resolutions for the New Financial Year 2016-17

- 8600 CE is having Highest OI at 64.2 lakh, resistance at 8600 .8400/8700 CE added 22 lakh so bears forming resistance at higher levels, at 8600-8650 zone .FII bought 8.4 K CE longs and 2.1 K CE were shorted by them .Retail sold 6.4 K CE contracts and 8.5 K shorted CE were covered by them.

- 8400 PE OI@56.3 lakhs having the highest OI strong support at 8400. 8200-8600 PE liquidated 21Lakh in OI so bulls making strong base near 8300-8400 zone .FII bought 10.2 K PE longs and 3.7 K PE were shorted by them .Retail sold 96.6 K PE contracts and 49.8 K shorted PE were covered by them.

- FII’s bought 420 cores in Equity and DII’s sold 372 cores in cash segment.INR closed at 67.18

- Nifty Futures Trend Deciding level is 8551 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8462 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8533 Tgt 8550,8577 and 8600 (Nifty Spot Levels)

Sell below 8480 Tgt 8450,8424 and 8400(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Sir ou are great

dear sir,

did nifty formed outside day pattern. since the high was higher than previous day & low was lower than previous day.

Sir u suggest if tata steel hold 369 than target is 377 but i buy tata steel and now is downward can you suggest me for tata steel can i hold or exit please tell me sir i am waiting your reply

Dear Sir,

Please read the article http://www.brameshtechanalysis.com/2014/08/how-to-trade-intraday-and-positional-calls/

Please make foundation strong else building will crumble..

Sir is our Shakitmaan .He can strech any time if he likes .

He is not working he is Worshiping!!

We should worship our work 🙂

Great job… Same question… Me too

Sir how many hours you work in a day?

lol

When you are passionate time just fly

wow…well said sir !!

Very good question