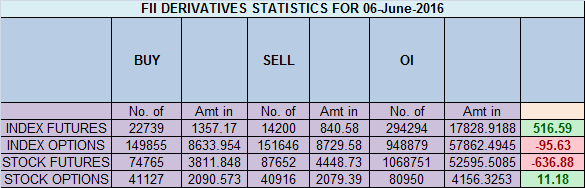

- FII’s bought 8.5 K contract of Index Future worth 516 cores ,5.7 K Long contract were added by FII’s and 2.8 K short contracts were liquidated by FII’s. Net Open Interest increased by 2.8 K contract, so fall in market was used by FII’s to enter long and exit shorts in Index futures.Mental Toughness Required by Traders Part-I

- As discussed in Yesterday Analysis Trade for coming 2 days should be long above 8242 for target of 8336 and below 8210 correction till 8134. Nifty made high of 8235 and Low of 8184 and closed below 8210, So closed just on gann trendline as shown in below chart, Now as we have RBI policy tommrow and also gann turn date in next 2 days so we can see impulsive move. Close above 8242 can lead to 8300/8336/8392. Below 8200 can see downmove towards 8140/8080. As we have said in previous analysis till 7972 is protected trend is buy on dips. Bank Nifty close above 17670,EOD Analysis

- Nifty June Future Open Interest Volume is at 2.09 core with liquidation of 2 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @7961 closed above it

- Total Future & Option trading volume was at 1.21 Lakh core with total contract traded at 0.87 lakh Lowest of 2016 , PCR @1.10, Trader’s Resolutions for the New Financial Year 2016-17

- 8400 CE is having Highest OI at 44.9 lakh, resistance at 8400 .8000/8600 CE bought 5.5 lakh so bears forming resistance at higher levels as nifty unable to close above 8241 .FII bought 2 K CE longs and 13 CE were shorted by them .Retail bought 15.7 K CE contracts and 11.1 K CE were shorted by them.

- 8000 PE OI@59.9 lakhs having the highest OI strong support at 8000. 8000-8600 PE added 4.7 Lakh in OI so strong base near 8000-8100 zone .FII bought 834 PE longs and 4.6 K PE were shorted by them .Retail bought 21.4 K PE contracts and 4.6 K shorted PE were covered by them. Retailers going in RBI policy with bearish bias.

- FII’s bought 28 cores in Equity and DII’s sold 230 cores in cash segment.INR closed at 66.97

- Nifty Futures Trend Deciding level is 8235 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8180 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8250 Tgt 8275,8300 and 8332 (Nifty Spot Levels)

Sell below 8180 Tgt 8130,8100 and 8070 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh