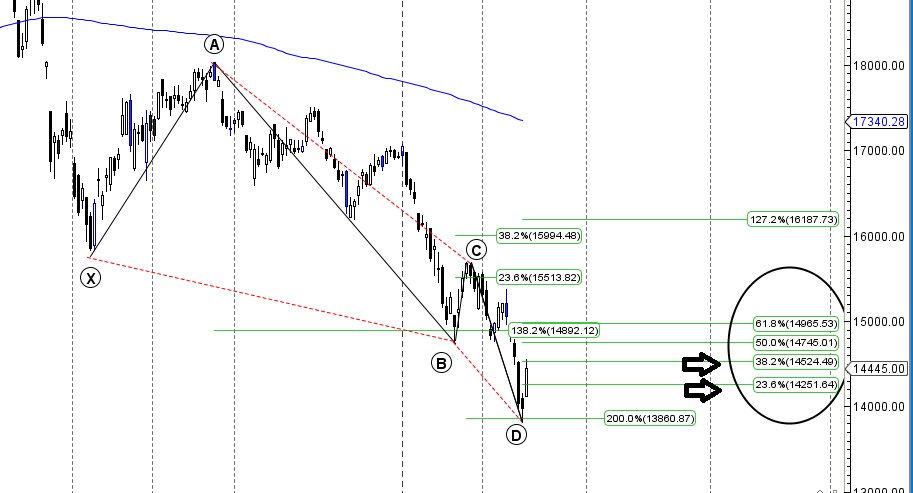

- As discussed in last analysis Nifty continued with the fall and closed near its 200 W SMA also forming a Hammer candlestick near the gann arc, suggesting we are near bottom for the time being. Bulls need to close above 14338. Till it do not close above 14338 any rise will be short covering rally if and when it comes. Market obliged us and gave the much expected rally in style with Bank Nifty up more than 500 points, If plan is ready we just need to execute it keeping risk to reward in mind Also Weekly Analysis Black Swan harmonic pattern which got completed at 13810 and we saw the expected rally above 14150.We need to close above 14524 for next move towards 14745/14965. Hope traders have got benefited out of the analysis, Beauty of Harmonic pattern is we have small SL and target are big so we have good risk to reward ratio Why Most Traders Fail

- Bank Nifty February Future Open Interest Volume is at 23.3 lakh with liquidation of 3.3 Lakh with decrease in Cost of Carry suggesting long positions were closed today .Bank Nifty again gave 1500 points move below rollover cost @ 15441. How To Identify Market Tops and Bottom

- 15000 CE is having highest OI @8.7 Lakh strong resistance formation @15500. 14500 CE saw 0.43 Lakh liquidation as bears booked profit and 14500 CE .14000-16000 CE added 0.09 Lakh in addition in OI so bears did not add any position.

- 13500 PE is having highest OI @3.6 lakh, strong support at 13500, Bears added aggressively 14000/14200 PE.13500-15500 PE saw 1.6 lakh addition suggesting so bulls got lease of life today.

- Bank Nifty Futures Trend Deciding level is 14391 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 14455.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Traders who took trade as per TC levels are rewarded with almost 2000 Points

Buy above 14450 Tgt 14530,14620 and 14760 (Bank Nifty Spot Levels)

Sell below 14350 Tgt 14220,14120 and 13950 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates