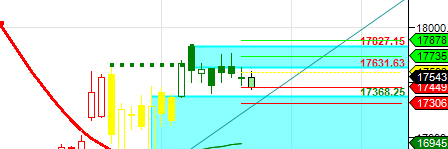

- Bank Nifty continued in consolidation mode forming lower low lower highs, As shown in below Pyrapoint chart on Hourly time frame Bank nifty is in perfect consolidation mode. Bank Nifty has becomes proxy for IT index to manage the index, As IT heavyweight TCS and INfy have been going down on account of poor quarterly results, Bank Nifty has been used to manage index from falling, hence trading in small range .17850 is breakout area for 18050/18144 and 17350 is breakdown area for 17177/17000, In between its pure consolidation mode. Picking Tops and Bottoms: Is It for You?

- Bank Nifty October Future Open Interest Volume is at 22.2 lakh with addition of 0.08 Lakh with increase in CoC suggesting long position were added today. Rollover cost @17334, and bank nifty closed above it but near rollover price.

- 18000 CE OI at 6.7 lakh with addition of 0.89 lakh suggesting , wall of resistance @ 18000 .17500 CE liquidated 0.01 lakh so bears did not add position. 17000-18000 CE added 1.07 Lakh, Bears added aggressively today.

- 17000 PE OI@ 6.8 lakhs strong base @ 17000. 16500/17000 PE added 0.38 lakh so bulls also added as Bank nifty close was above 17500. 16000/17000 PE added 0.36 lakh.

- Bank Nifty Futures Trend Deciding level is 17543 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 17496 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 17630 Tgt 17690,17780 and 17850 (Bank Nifty Spot Levels)

Sell below 17450 Tgt 17370,17300 and 17200 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Today BNF future breached 18k. Brace for Monday gap around 18300.

BNF finds continuous buying in 17500-17550 zone and a day back 17550-17610 zone.. Buyers are constants present and they are ready to pull BNF goes day… May b they seeing the strength of sellers in the couple of past trading session TPO count was in favour of Buyers but not aggressive buyers. Short covering at 17680 was seen on 13-oct. So shorts are also not sure about the downside.

get ready for a ride till 20200 on BN in Oct series..

any logic behind your view

Its no calm before storm.. its just a frustrating, complex B wave.. we are used to heavy volatility in BN… and that may soon happen in a day or two..

there are no triggers foreseeable for 20K before Dec… even a 50bps cut could not take it past 18K…

There are times when no logic and technical works. People keep wondering whats going on ? I think its calm before storm.