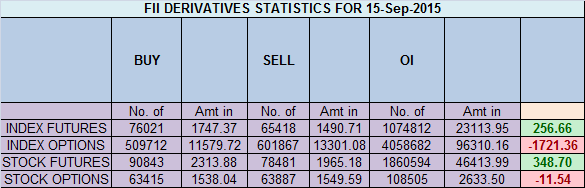

- FII’s sold 1.3 K contract of Index Future worth 50 cores ,16.7 K Long contract were squared off by FII’s and 15.3 K short contracts were squared of by FII’s. Net Open Interest decreased by 32.1 K contract, so today’s rise in market was used by FII’s to exit both long and shorts in Index futures Five Fed Scenarios & The Market Impact

- Nifty closed above its gann trendline resistance as shown below gunner chart,will be see follow up move till 7948/8050 on Upside, In case of failed breakout we can see downmove till 7700/7650. Five Fed Scenarios & The Market Impact

- Nifty September Future Open Interest Volume is at 2.15 core with liquidation of 6.8 Lakh with decrease in CoC suggesting long position have booked profit today. Rollover stand at 65 % and avg cost of rollover @ 7998.

- Total Future & Option trading volume was at 2.01 Lakh core with total contract traded at 4.4 lakh . PCR @1.04

- 8000 CE OI at 43.5 lakh , wall of resistance @ 8000 .7700/8200 CE added 4.4 lakh in OI so bears continue adding and holding 115 Lakh. FII sold 1.4K CE longs and 39.9 K CE were shorted by them.Retail bought 40 K CE contracts.

- 7500 PE OI@ 48.5 lakhs strong base @ 7500. 7600/8100 PE added 13.1 lakh so bulls added aggressively before the Fed event . FII bought 1.4 K PE longs and 66.9 K PE were shorted by them.Retail bought 143 K PE contracts and 40.1 K contracts were shorted by them.

- FII’s sold 337 cores in Equity and DII’s bought 423 cores in cash segment.INR closed at 66.46 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7889 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7827 and BNF Trend Deciding Level 16919 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 16681 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7924 Tgt 7950,7984 and 8050 (Nifty Spot Levels)

Sell below 7880 Tgt 7830,7800 and 7750 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

I think fii covered 40k shorted calls.. not fii shorted 40k calls

Bramesh,

What does “filed breakout” means?

its typo error its failed breakout