- FII’s sold 104 K contract of Index Future worth 2416 cores ,33.9 K Long contract were squared off by FII’s and 70.5 K short contracts were added by FII’s. Net Open Interest increased by 36.6K contract, so today’s fall in market was used by FII’s to exit long and enter shorts in index futures .Want to be Profitable Trader,Develop the following Qualities

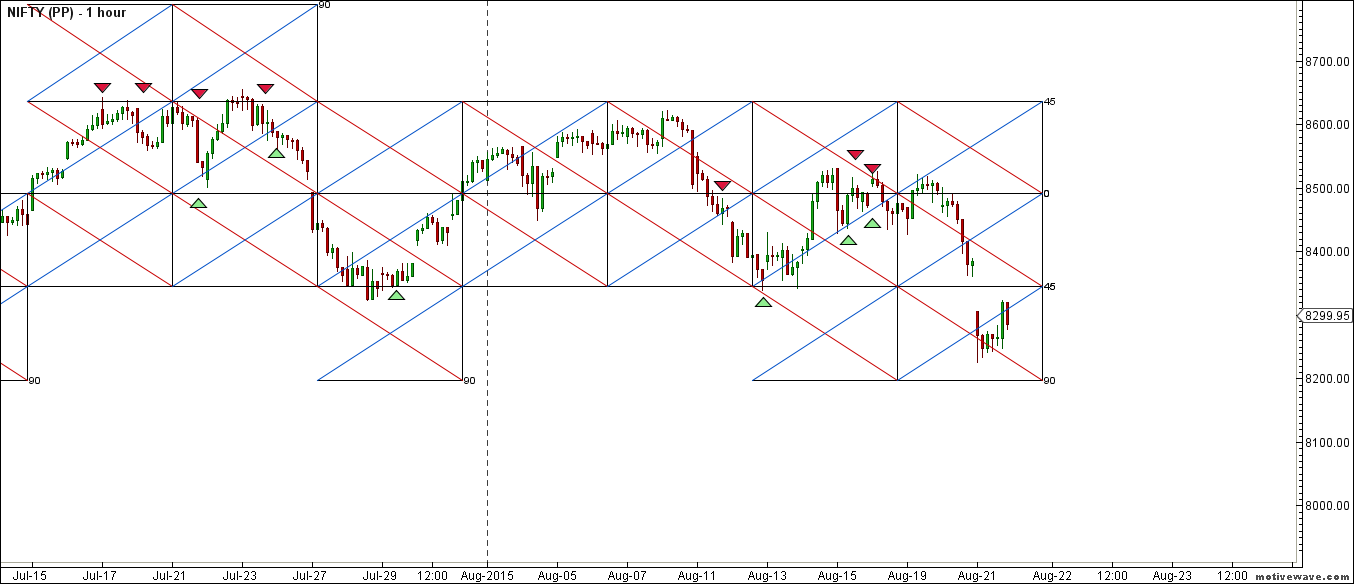

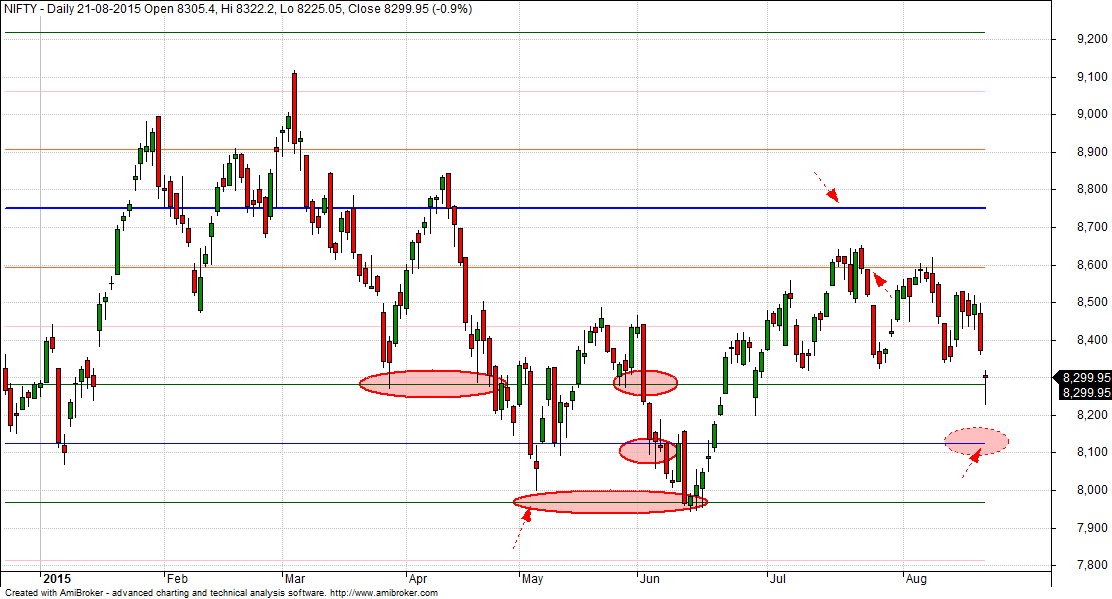

- Nifty opened with huge gap down, continued to trade in small range and showed sign off short covering during the last hour. Now again Nifty will open Gap down of Monday taking cues from global market and most likely will break the 90 degree pyrapoint line suggesting a move towards 8165/8124 is possible. MML support zone is shown in below chart.Weekly Analysis for Nifty and Bank Nifty

- Nifty August Future Open Interest Volume is at 1.47 core with addition of 0.79 Lakh, with decrease in CoC suggesting short positions got added today.NF Rollover price gave almost 200 points from 8503

- Total Future & Option trading volume was at 4.12 core with total contract traded at 6.7 lakh . PCR @0.94.

- 8400 CE OI at 41.5 lakh , wall of resistance @ 8400 .8200/8500 CE added 37 lakh in OI so bears added aggressively today in 8400 /8300 CE. FII bought 35 K CE longs and 25.8 K CE were shorted by them.Retail bought 160 K CE contracts and 103 K CE were shorted by them.

- 8200 PE OI@ 54 lakhs strong base @ 8200. 8300/8600 PE liquidated 33 lakh so major liquidation was seen in 8400/8500 PE still bulls are holding and 33 lakh from start of series . FII bought 52 K PE longs and 11.4K shorted PE were covered by them.Retail sold 29 K PE contracts and 50 K PE contracts were shorted by them.Retailers buying CE and market falling down.

- FII’s sold 2340 cores in Equity and DII’s bought 1524 cores in cash segment.INR closed at 65.83 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 8307 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8496 and BNF Trend Deciding Level 17972 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18718 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .NF and BNF gave 200 and 700 point in just 2 trading sessions after 2 whipsaws.

Buy above 8185 Tgt 8205,8240 and 8282 (Nifty Spot Levels)

Sell below 8145 Tgt 8124,8100 and 8080 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir, what is 1lot size of nifty future from October. How much money is required to by 1lot. And what will be the brokerage approx.

Puneeth,

Please dont ask such questions in this forum. I know no question is a foolish question but even then. You can first go and get yourself updated rather than coming to this post as a wandered and post such questions. If you don’t know even the lot size of Nifty from October then I highly doubt your presense here. I am sorry Bramesh and anyone who would not have liked me challenging this question but I could not stop myself.

Is it implied that only sell below 8185 is in vogue now as the closing is @8299 ? Am I getting it correct?

I hope you revisit nifty buy/sell levels above as both sets are below nifty cmp at 8299.95. Thanks

Indian Market are likely to open gap down of 100-150 points thats why we have kept such levels.

Rgds,

Bramesh

Dear Sir, in Bank Nifty Demand Supply chart it is not showing candlestick of 21st August.

Updated chart

I think you have written 8615 instead of 8165

Thanks Varun its updated..