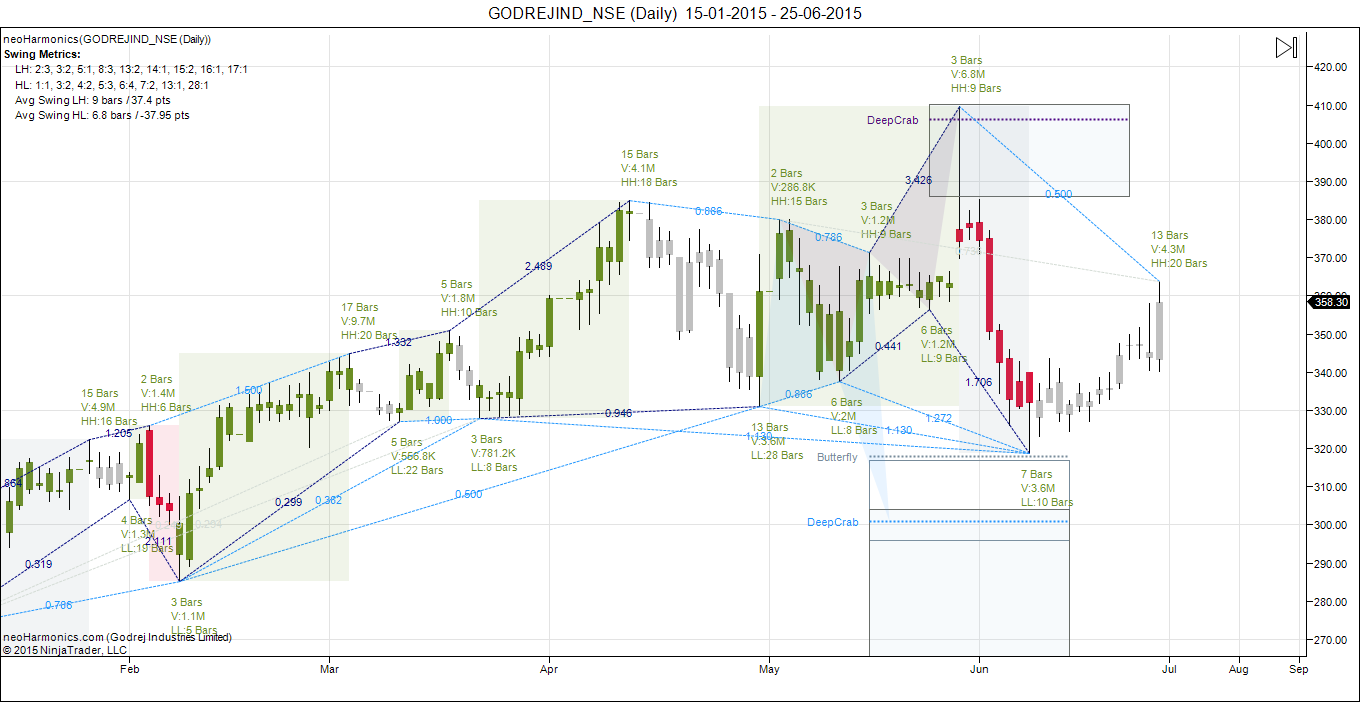

Titan

Positional/Swing Traders can use the below mentioned levels

Any close above 356 short term target 364

Intraday Traders can use the below mentioned levels

Buy above 354 Tgt 356,359 and 362 SL 352.5

Sell below 352 Tgt 350, 346 and 342 SL 353

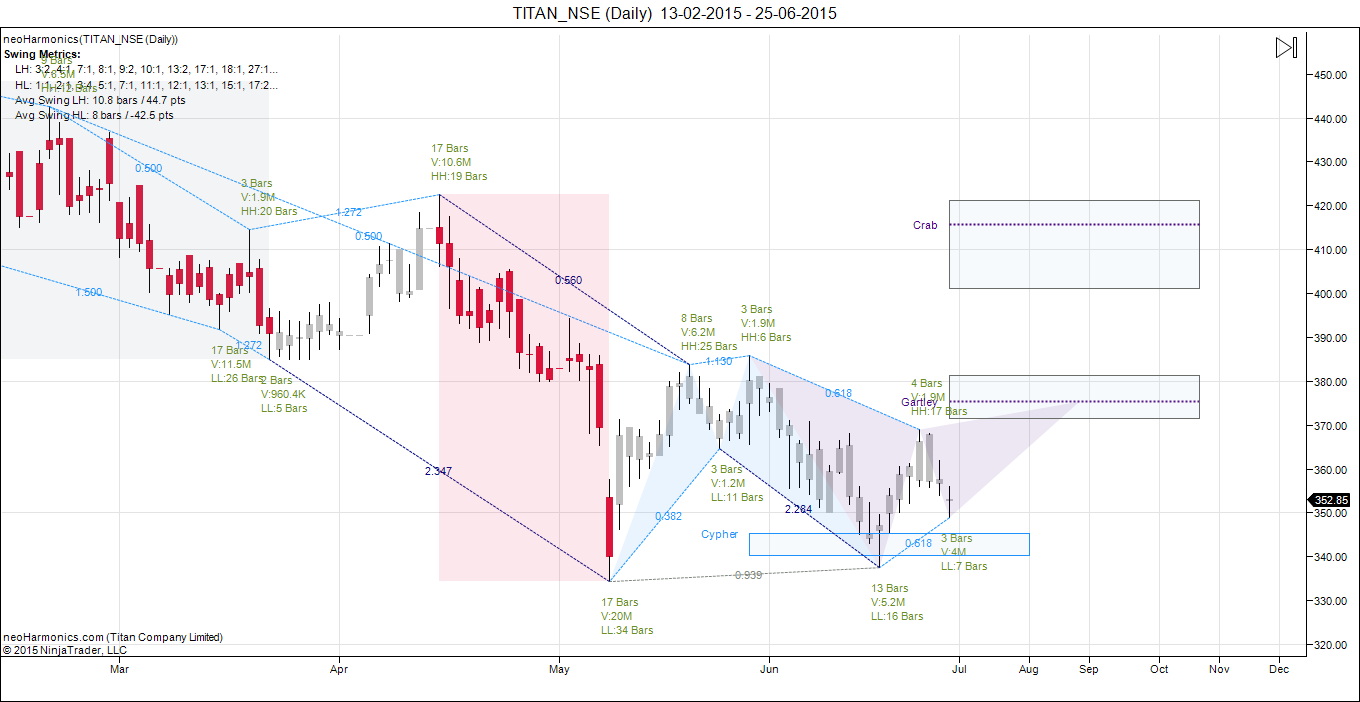

Maruti

Positional/Swing Traders can use the below mentioned levels

Unable to close above 4037 short term target 3948 and 3804

Intraday Traders can use the below mentioned levels

Buy above 4044 Tgt 4055,4079 and 4115 SL 4030

Sell below 4015 Tgt 3995, 3960and 3935 SL 4030

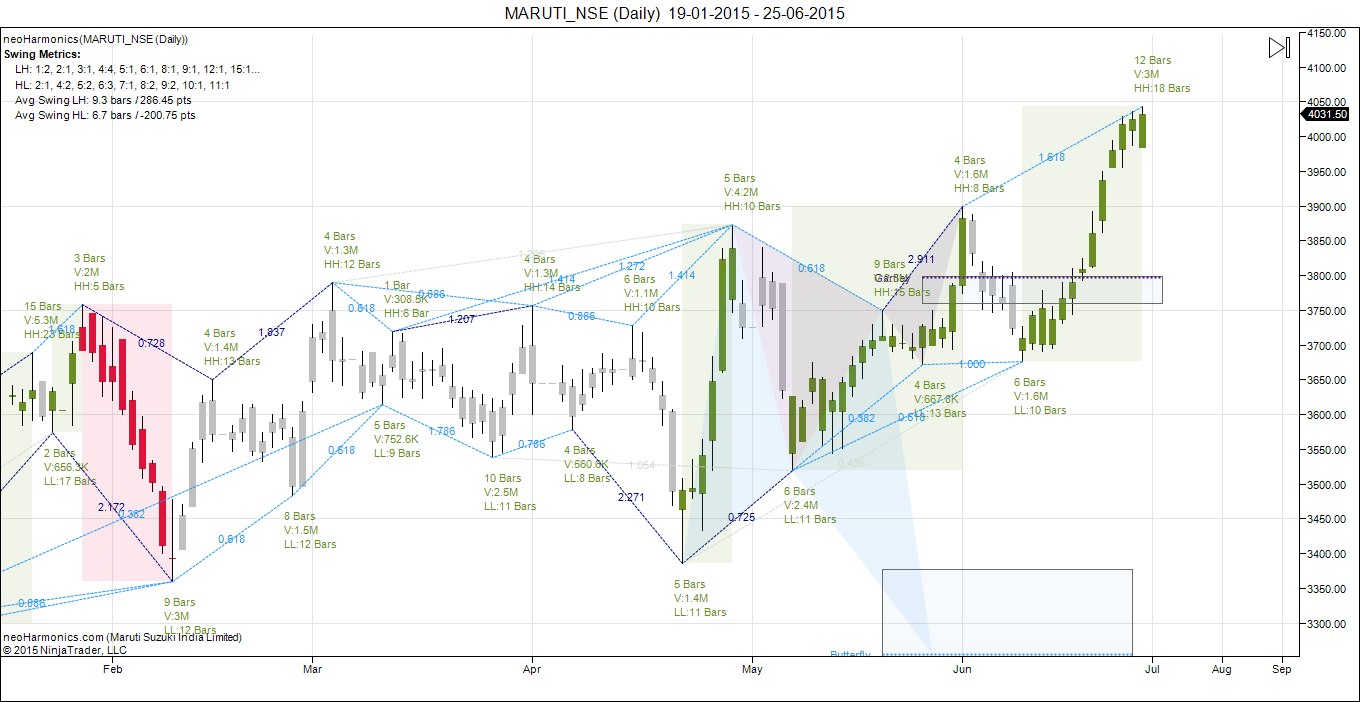

Godrej Industries

Positional/Swing Traders can use the below mentioned levels

Any close below 356 short term target 343

Intraday Traders can use the below mentioned levels

Buy above 360 Tgt 362,364 and 368 SL 358

Sell below 356 Tgt 354, 352 and 350 SL 358

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for June Month, Intraday Profit of 1.97 Lakh and Positional Profit of 1.93 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Hi Bramesh,

I’ve been following your intra calls for a quite some time now. They have been working well. I have a query regarding your calls. Sometimes what happens is when you book the profit on 1st target, price tend to go toward 2nd and 3rd target and end-up achieving 3rd target. Sometimes when price touch the 1st target and we wait for price to move towards 2nd and 3rd target, it just retraces and hit the stop-loss. So my query is:

-How to decide when to wait for price to move toward 2nd or 3rd target or when to book profit at 1st target only and move out from the market?

Your explanation on this will be a great help.

Trade in multiple lots and book profits on each target. If you cannot trade multiple lots trade in cash market.

Thank You, Bramesh.

Is it good take trade at 09:15 candle sir?

I miss some trades at 09:15 candles as it is so volatile. Sometimes they are profitable. Pls give any suggestion on this sir.

at 9:15 yes if opportunity comes you can. Do understand movement will be very fast and sometime it will move very fast. Trade with utmost patience.

Hi,

One question which may be boggling many others as well.

1) Is there a stock broker that offers the software to buy sell just as the way you give the calls i.e buy above x, then wait for targets a,b,c .. put sl at y. Ofcourse trailing SL to be there.

2) Is there a broker who just offers atleast the trailing SLoption. I havent come across good ones.

3) If it is not asking too much, which client/broker are you with and are you using?

Cheers

Ram

Dear Ram,

Everyone wants to trade by seeing the levels on site. Instead of doing why do not you paper trade for few days get comfortable with levels, get accustomed to your risk profile and your trading psyche.

Once you have achieved this any software will work. These are just tool most important link in trading is “UNDERSTANDING YOURSELF” .

Rgds,

Bramesh

Thanks Bramesh for responding.. I have been paper trading since 5-6 months now. I am at a little comfortable level though not a pro ofcourse.. But converting the levels to actual trades is taking time, the targets are fast achieved and we hardly have time to put in our trades. Because of that time lag, we are entering the trades late and all the happening is almost over.

By the way, I am using NEST trader but this type of buying at trigger levels is not there(If its a SL-L order, it cant be a TSL order). we can put a TSL order but there is no ease / convenience and many times, the SL will not be at the correct price as it is relative to the buy price. Please advice.

What I am looking at a software is to diligently follow the buy above x, then wait for targets a,b,c .. put sl at y and TSL. Basically automated and disciplined buy/sell withour intervention. This way we cut our emotions far better.

Please let us know. Hope many people are interested in looking at an answer for this.

Please check with your broker, these should be available.

i dint know answers for your 1&2 questions . For the 3 rd : Zeodha is offering Trailing stop loss with discount brokerage!

All S/w ODIN/NEST have TSL facility.

If your trading account is small never go for discount brokers, traders tend to overtrade and lose their capital with such brokers.

Rgds,

Bramesh

Sir, Maruti positional trading if it does not close above today 4037 then I have to short it at the end of day? What should be the stop loss? Please guide……with example….Jay Jinendra

Jai Jinendra

Please read this http://www.brameshtechanalysis.com/2014/08/how-to-trade-intraday-and-positional-calls/