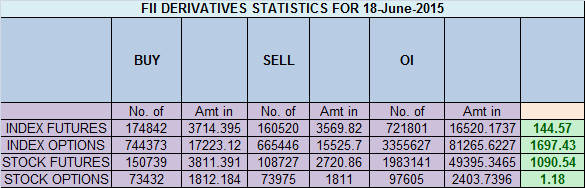

- FII’s sold 14.3 K contract of Index Future worth 144 cores ,32 K Long contract were added by FII’s and 17.7 K short contracts were added by FII’s. Net Open Interest increased by 49.7 K contract, so todays rise was used by FII’s to add majority longs and partial shorts in index futures. What happens when US FED Hikes Interest Rate

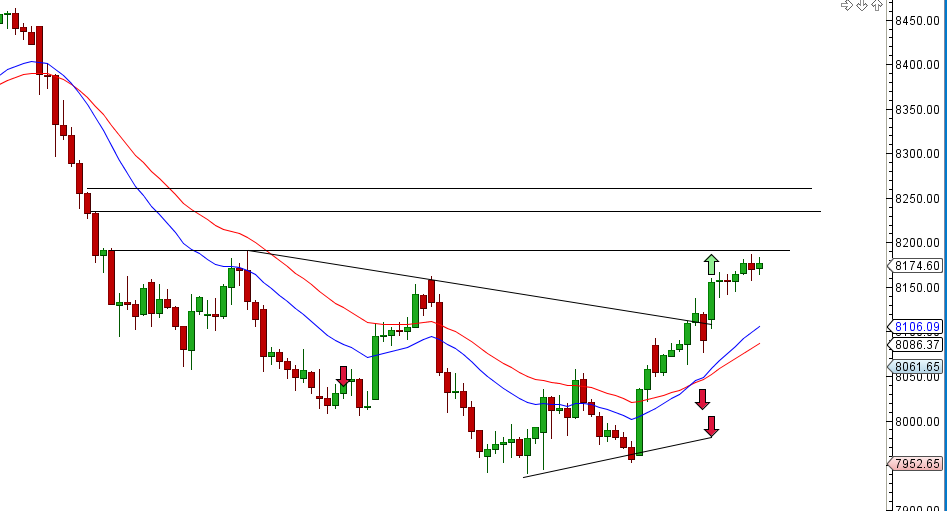

- This is what we have discussed in last few analysis We have been advocating the range of 7930-7950 being the demand zone for Nifty from 11 June Nifty made the following lows 7958,7940,7944 and 7946 also we have discussed in Weekly Analysis from 14 June time cycle has changed to neutral to Bullish, market obliged with 5 green close from past 5 days. Also Nifty has completed 2 crucial harmonic pattern ABCD and BAT pattern both are bullish if 7930 is held. Traders who bought should have been rewarded, As per gann angles above 8100 we can move towards 8189/8211 odd levels. and pyrapoint, also suggests 8195 on cards. Gann Angle 8×1 comes @8224, Trendline resistance also comes at 8239/8254 and Gunner also suggest green arc will be short term target.

- Nifty June Future Open Interest Volume is at 1.58 core with addition of 2.2 Lakh, with decrease in CoC suggesting shorts have entered in system

- Total Future & Option trading volume was at 2.77 core with total contract traded at 5.4 lakh. PCR @1.17 huge jump in PCR.

- 8500 CE OI at 47.4 lakh , wall of resistance @ 8500 .8000/8500 CE liquidated 20 lakh ,so bears finally gave up and liquidated major positions . FII bought 67.5 K CE longs and 17.3 K shorted CE were covered by them.Retail sold 1.16 lakh CE contracts. So FII’s bought heavily in CE contact highest in series.

- 8000 PE OI@ 63.3 lakhs so strong base @ 8000. 8100/8500 PE added1 4 lakh so bulls added aggressively today so 8100 is coming up to be strong support . FII bought 29 K PE longs and 35.1 K PE were shorted by them.Retail bought 1.38 lakh PE contracts.So FII’s long in CE and Retailers long in PE, so again its smart money which wins retailers holding short and market rising.

- FII’s sold 784 cores in Equity and DII’s bought 1110 cores in cash segment.INR closed at 63.73

- Nifty Futures Trend Deciding level is 8151 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8146 and BNF Trend Deciding Level 17686 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17795 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8188 Tgt 8207,8236 and 8254 (Nifty Spot Levels)

Sell below 8150 Tgt 8122,8100 and 8070 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hi, I have a question on this statement, “So FII’s long in CE and Retailers long in PE, so again its smart money which wins retailers holding short and market rising.” If Retailers are long in PE, then they should be losing money when markets rising, right?

Any one FII/DII/Retail are against the trend they will lose money.

Rgds,

Bramesh

Hi Bramhesh ji your this week analysis RIGHT ON TARGET Kudos rewarding 250 points

I would like to know whether this series will end up 8130 as FII’s are holding huge put longs and on selling spree

Thanks for you pyrapoint analysis now a days Elliot analysis is it irrelevant for this seris

We are not in a Business of predicting on what going to happen. Follow the levels with discipline is simple funda.

What will happen, where it will been i am least bothered about.

No study is irrelevant as per my experience.

Rgds,

Bramesh

Bramesh G

can i sell with sl of 8254

if gap up opening bring nifty spot reades near 8239…??

Go with flow till reversal signal are visible.

Hi Bramesh,

yesterday’s FII and DII equity amounts are mentioned in todays article. Today(18th) FII’s sold 784 crore and DII’s bought 1110 crores. please correct. Thanks

Thanks its updated..

Nasdaq is making all time highs today. Bullishness is all set to continue tomorrow. 8300-8350 zone is probably the next major resistance.