Its been 1100 + Points Rally in Nifty in last 10 trading session many traders asked me “Can money be made in trading ?” Let me try to answer the same.

Trading is always a high return high risk game and it needs nimble trading approach with tons of discipline.

Traders say its the Big traders who move the market and we end up making loss.

Well i do not buy this reasoning. The most Important part in trading is trading discipline and trading system(Throughly Backtested)

Some general reason why traders loose money

Mistake # 1: Jumping in with Both Feet

Would you perform a surgery, or fly a plane loaded with passengers without any previous training? Of course not. That would be insane.

But when it comes to trading the markets, that’s exactly what a lot of people do. They jump right in, without any kind of guidance or plan because they feel confident they can beat the market.

But making money trading the markets is not easy. If it was, you could just quit your day job, buy a little condo on some tropical island and never look back.

Now is it possible to reach that point? Sure. But it’s not going to happen overnight.

So before you start trading, you need to make sure you have a plan.

After learning the basics of the market, you should start out with a paper trade account to try out a specific trading strategy. Then you can move on to real money trades, risking a small percentage of your portfolio.

There’s an African proverb that says “only a fool tests the depth of the water with both feet.” When trading the markets, it’s always a good idea to tiptoe before getting into the water.

Mistake # 2: Eating Like a Sparrow, but Defecating like an Elephant

Back in the 1960s, a pair of Canadian psychologists made an unusual discovery.

They determined that after placing a bet at the racetrack, people feel much more confident about their chances of winning than they did prior to making the bet.

That’s just the way our brains are wired. Once we make a choice, we tend to find ways to justify our earlier decisions.

This instinctive response can be dangerous in the market.

If a trade starts to move against you…you may find many reasons to “hold on,” hoping it will turn around.

And vice versa. If you get into a trade and it soars higher, you may take profits too early. Or even worse, you may hold out so long that your winner turns into a loser.

End result: you either wind up eating like a sparrow, where you nervously close out small gains. Or you defecate like an elephant – holding onto losers until they swamp any gains you made.

One way to protect you capital is to always use stop losses. And always know – before you get into a trade – where you plan to take profits.

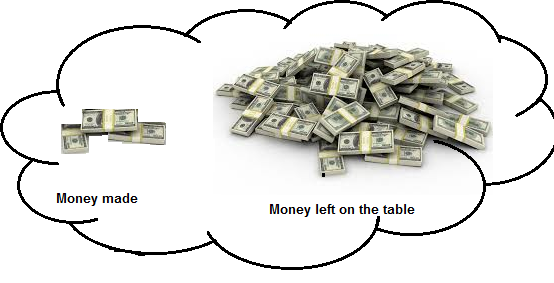

Mistake #3: Focusing on Making a Loads of Money

The 1980′s movie Wall Street coined the term “greed is good.” But things are different in real life.

If you only focus on making money when trading the markets, it’s very likely you will lose it all. When greed takes over, traders make huge mistakes, such as betting all in one single trade or not using any stop losses.

Before placing a trade, you should always ask yourself “how much will I lose if this trade goes wrong?”

But many traders have no clue how much capital they’re risking on any single trade.

That’s a mistake.

All the most successful traders focus on limiting risk and protecting capital, rather than just making money. By limiting their downside, they successfully grow their account over time.

You can easily copy their strategy.

As I mentioned before, start by always using a stop-loss. That will protect you from losing too much.

But equally important: you should also limit the amount you risk on every single trade. I recommend risking no more than 5% of your account on any trade.

As you can see, letting emotions get in the way of your trading is not a good idea.

If you’re making any of the mistakes mentioned above, it’s only a matter of time before your account will blow up. Most traders learn this the hard way.

But if you avoid these three key pitfalls, you will not only save money, but also become a better trader: one step closer to complete financial independence.