Bank Nifty again got its correction from purple line based on (Gann Master Level Indicator) ON 28 we have Venus Yod Uranus and Mercury Square Jupiter HELIO Aspect which is crucial for Global Market , Uranus is Stock Market plannet so will have big impact on Global Stock Market.

Tommrow Bayrs Rule 9 will come into affect Bayer Rule 9: Big changes on market are when Mercury passes over 19 degrees 36 minutes of Scorpio and Sagittarius,also over 24 degrees 14 minutes of Capricorn. For Intraday traders first 15 mins High and LOw will guide for the day.

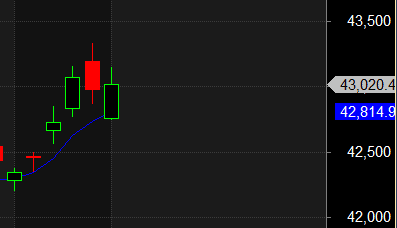

For Swing Trade Bulls need to move above 43131 for a move towards 43339/43640/43846 . Bears will get active below 42818 for a move towards 42613/42408/42202.

Intraday time for reversal can be at 10:36/11:39/12:07/1:13/2:01 How to Find and Trade Intraday Reversal Times

Bank Nifty Dec Future Open Interest Volume is at 28.1 lakh with addition of 0.27 Lakh contract , with decrease in Cost of Carry suggesting Long positions were added today.

Bank NIfty Rollover cost @42828 and Rollover % @81.3.. CLosed above it, Bank NIfty Future is in premium has reduced today from 308 to 255 points.

We can see a Spike in VIX also so trader can create Long Straddle in Bank Nifty. 43000 CE and PE combined is 424 points only with 3 days left to expiry. Long can be taken in 43000 Long Straddle with a 108 point SL and target of 225/385 points.

Till Bank Nifty is above 42814 on closing basis Bulls will have upper hand.

Maximum Call open interest of 32 lakh contracts was seen at 43500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 34 lakh contracts was seen at 42500 strike, which will act as a crucial Support level.

MAX Pain is at 43000 and PCR @0.92 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

As a short-term trader, even if you develop the correct bias about the direction of the market, You still must possess the trading skills to capture these moves.

For Positional Traders Trend Change Level is 43252 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 42256 will act as a Intraday Trend Change Level.