- FII’s sold 564 contract of Index Future worth 32 cores ,2.3 K Long contract were added by FII’s and 2.9 K short contracts were added by FII’s. Net Open Interest increased by 5.2 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. GST Impact on stocks

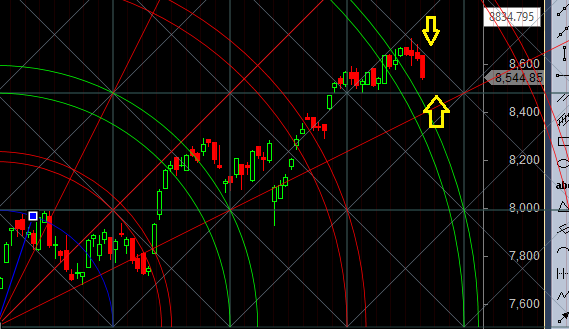

- As discussed in Yesterday Analysis Bearish only on close below 8577 and bullish on close above 8677 in between yo-yo move, We have gann date tomorrow expect impulsive move as price is also trading horizontal line from past 2 trading session. Finally we closed below 8577 suggesting bears have the upperhand now, As we have GST bill getting passed in parliament today, so chances of gap up opening and if we open above 8577 its prudent to cut short and go long. As a trader we need to be very flexible, and change color as market are changing. Never let your biases hold you back in taking right trading decision, Its possible market open up above 8577 and by end of day closes below 8577 where traders can again initiate fresh position, Main aim is to protect capital. Close above 8677 will be bullish and nifty can see move till 8800.Close above the downward falling line will be bullish in short term. Bank Nifty reaction after Rajya Sabha passes historic GST Constitution Bill

- Nifty Aug Future Open Interest Volume is at 2.40 core with addition of 11.9 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @8650, High made exactly at 8650 and saw a decline of 80 points.

- Total Future & Option trading volume was at 3.11 Lakh core with total contract traded at 1.69 lakh , PCR @0.73, Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 43.4 lakh, resistance at 8800 .8500/9000 CE added 26.9 lakh so resistance formation in 8800-8900 .FII bought 983 CE longs and 16.8 K CE were shorted by them .Retail bought 107 K CE contracts and 44.2 K CE were shorted by them.

- 8500 PE OI@43.4 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 6.2 Lakh in OI so bulls making strong base near 8500-8550 zone .FII bought 25 K PE longs and 1.5 K PE were shorted by them .Retail sold 3.7 K PE contracts and 28.1 K PE were shorted by them.

- FII’s bought 578 cores in Equity and DII’s sold 800 cores in cash segment.INR closed at 66.99

- Nifty Futures Trend Deciding level is 8608 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8671 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8610 Tgt 8640,8671 and 8700 (Nifty Spot Levels)

Sell below 8570 Tgt 8540,8505 and 8464 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

If Nifty tests 8490, you can expect a big fall tomorrow in nifty. Be cautious if you are in Buy. Mandatory stop loss should be there if you are in Buy. But I don’t recommend to buy…

Tomorrow support will come in at 8520 if comes there…chances are high gapup open above 8577 and can go till 8677 with out coming down…pure buy..

My tgts reached in the first hour itself Mr.Bramesh

Bulls need to trade above 8614 for the tgts mentioned above. If it opens gap up go short with a SL of 8620 spot lvls. Go long above 8620 on hourly close. Downside targets if nifty does not sustain above 8620 are 8535/8503/8490

Atte uttam Sir ji