- FII’s bought 10.6 K contract of Index Future worth 711 cores ,7.3 K Long contract were added by FII’s and 3.3 K short contracts were liquidated by FII’s. Net Open Interest increased by 3.9 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. Why Traders lose money Part-I

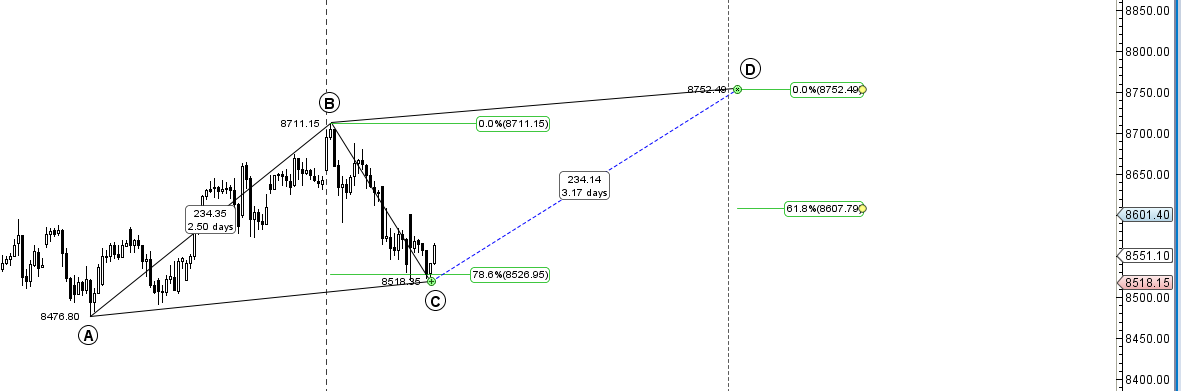

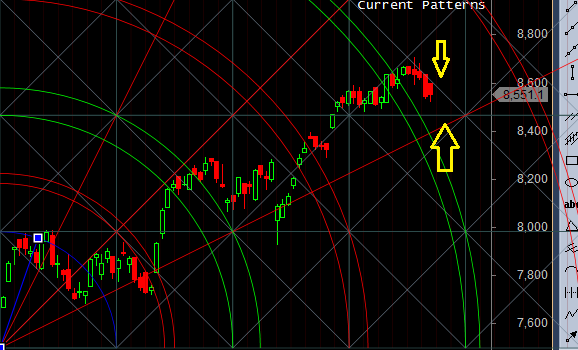

- As discussed in Yesterday Analysis Finally we closed below 8577 suggesting bears have the upperhand now, As we have GST bill getting passed in parliament today, so chances of gap up opening and if we open above 8577 its prudent to cut short and go long. Again technical worked and gap up above 8577 got sold into , but with today’s fall after event and recovery suggest strong buying at lower levels, also as seen in below ABCD pattern todays low was made near 78.6% retracement suggesting range of 8518-8500 range is important now, Holding the same we can see move till 8752 levels in coming week. Close below 8515 invalidate the pattern, Also as per gann analysis close above 8577 will be bullish. Best is to go long above 8607 which is falling gann line as shown below add more if it close above 8677 for eventual target of 8752, Adding to winning position is called pyramiding which most of professional traders do. Bank Nifty forms Bullish Cypher pattern,EOD Analysis

- Nifty Aug Future Open Interest Volume is at 2.37 core with liquidation of 2.8 Lakh with decrease in cost of carry suggesting short position were closed today, NF Rollover cost @8650, High made exactly at 8634 and saw a decline of 70 points.

- Total Future & Option trading volume was at 4.60 Lakh core with total contract traded at 1.43 lakh , PCR @0.74, Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 58.3 lakh, resistance at 8800 .8500/9000 CE liquidated 20.9 lakh so resistance formation in 8800-8900 .FII bought 3.3 K CE longs and 4.2 K CE were shorted by them .Retail sold 107 K CE contracts and 62.2 K shorted CE were covered by them.Retailers bought aggressive longs before event even though nifty ended in green all option IV came down and all call options went in red.

- 8500 PE OI@46 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 5.9 Lakh in OI so bulls making strong base near 8500-8550 zone .FII bought 27.7 K PE longs and 1.5 K shorted PE were covered by them .Retail sold 17.5 K PE contracts and 1.6 K shorted PE were covered by them.

- FII’s bought 559 cores in Equity and DII’s sold 527 cores in cash segment.INR closed at 66.92

- Nifty Futures Trend Deciding level is 8584(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8656 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8577 Tgt 8610,8641 and 8680 (Nifty Spot Levels)

Sell below 8550 Tgt 8520,8480 and 8440 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

sir how can we know today will be a trending day or a sideway day using the previous day vwap and todays opening….is there any formula for that ?? waiting for ur reply sir..

Range of 7518-7500 range is important

Pls correct

thanks its corrected

Time correction this time is too long so I think the target should be 8800 kind next week. 3% is normal after such a correction. Just like in June. I was surprised by the late buying. It was supposed to correct in second half considering the charts and 2 day close below 8577